We are Not a Commodity Exchange but On a Mission Helping You Make Money by Learning How to Trade London Futures for Profit

The U.K. based commodity futures and forex markets are popular and heavily traded. They trade in ways very similar to U.S. based futures. A good date to start trading profitably by learning how to trade the U.S. or U.K. commodity futures markets to make a success is today so study and learn all you can about trading without delay...

London is considered to be the financial centre of Europe plus a top international financial markets and trading centre. Commodity futures are heavily traded on various commodity markets including sugar, coffee, cocoa, barley, wheat, financial markets including currencies, oil markets and cargo freight futures and other commodity markets, stocks and options. Click now for Ready to Trade article.

London is considered to be the financial centre of Europe plus a top international financial markets and trading centre. Commodity futures are heavily traded on various commodity markets including sugar, coffee, cocoa, barley, wheat, financial markets including currencies, oil markets and cargo freight futures and other commodity markets, stocks and options. Click now for Ready to Trade article.

Trading commodity futures, forex and options in London or anywhere else is not for everyone. It's a volatile, complex and real high-risk activity with significant risk of loss but also great rewards are possible. Before investing money and trading futures or options contracts, you should:

- Review your futures trading experience and financial resources to understand how much money you can afford to lose in addition to initial account equity. Click now for Trading Tip-of-the-Day.

- Understand commodity futures and option contracts and your risk and obligations in trading futures contracts.

- Understand your risk exposure of commodities trading by reviewing all risk disclosure documents your broker is required to supply you.

- Know who to contact if you have future problems or questions.

Ask questions and get information well before you open a commodity exchange trading account. One more beneficial to your trading success step you can take is to search for commodity futures trading information by clicking-below to use our traders search engine...

The Basics of Commodity Trading

What is a Futures Trading Contract?

A commodity futures contract is an agreement to buy or sell in the future a specific quantity of a commodity at a specific price. Most futures contracts contemplate actual delivery of the commodity can take place to fulfill the contract.

A commodity futures contract is an agreement to buy or sell in the future a specific quantity of a commodity at a specific price. Most futures contracts contemplate actual delivery of the commodity can take place to fulfill the contract.

However, some futures contracts require cash settlement in lieu of actual commodity delivery, and most contracts are liquidated before the delivery date. An option on a commodity futures contract gives the buyer of the option the right to convert the option into a futures contract. Futures and options must be executed on the floor of a commodities-exchange—with very limited exceptions—and thru persons and firms who are registered with the CFTC.

Who Uses Futures and Options Markets?

Most of the participants in the futures and option markets are commercial or institutional users of the commodities they trade. These users, most of whom are called "hedgers," want the value of their assets to increase and want to limit, if possible, any loss in value. The term commodities hedging involves the trading of commodity market contracts to take positions mainly to reduce the risk of financial loss in their assets due to changes in price. Other market participants are "speculators" and "traders" who hope to make money by profits from commodity price quotes changes in the futures markets, or options contracts.A Brief History of Futures Trading

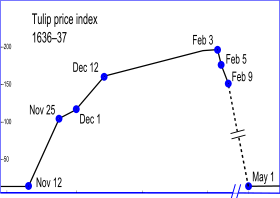

Futures contracts on agricultural commodities have been traded at organized or government regulated commodity exchanges for 100-years. In fact, the first commodity exchange was in Holland (modern-day Netherlands) way back in the year 1636 with agricultural trading of Tulip Bulbs. By the year 1637 a single tulip-bulb was amazingly priced higher than was an average size house in Amsterdam! It was famously known as The Tulip Bulb Mania involving astonishing price increases (see Tulip price index chart) from panic buying of tulip bulbs.

Futures contracts on agricultural commodities have been traded at organized or government regulated commodity exchanges for 100-years. In fact, the first commodity exchange was in Holland (modern-day Netherlands) way back in the year 1636 with agricultural trading of Tulip Bulbs. By the year 1637 a single tulip-bulb was amazingly priced higher than was an average size house in Amsterdam! It was famously known as The Tulip Bulb Mania involving astonishing price increases (see Tulip price index chart) from panic buying of tulip bulbs.

In the last few decades, futures trading has expanded rapidly into many new markets, beyond traditional physical and agricultural commodities markets. Futures and options now are offered on many energy commodities like crude oil, gasoline, heating oil and natural gas, as well as on a wide array of misc financial markets, including forex, foreign currencies, U.S. and foreign government securities, and U.S. and foreign stock indices. In recent years, new futures contracts have been offered in non-traditional commodity areas such as electricity, seafood, dairy products, crop yields and even the weather.

Contract Review and Market Surveillance

To ensure the financial and market integrity of the nation's commodities and futures markets, the CFTC reviews the terms and conditions of proposed futures and option contracts. Before an exchange lists a new futures or option contract for trading, it must certify that the contract complies with the requirements of the Commodity Exchange Act (CEA) and the Commission’s regulations, including the requirement contract terms reflect commercial trading practices and that the contract not be readily susceptible to manipulation. The Commission conducts daily market surveillance and, in an emergency, can order an exchange to take specific action or to restore order to any traded futures contract.

Regulation of Futures Professionals

Companies and individuals who handle customer funds or give trading advice must apply for registration via the NFA, a self-regulatory organization approved by the Commission.

The CFTC seeks to protect customers by the following:

- requiring registrants to disclose market risks and past performance information to prospective customers,

- requiring that customer funds be kept in accounts separate from those maintained by the firm for its own use, and

- requiring customer accounts to be adjusted to reflect the current market value at the close of trading each day.

The CFTC also monitors registrant supervision systems, internal controls, and sales practice compliance programs.

Commodity exchanges additional regulations with trading rules of their own covering clearance of trades, trade orders and records, position limits, price limits, disciplinary actions, floor trading practices and brokerage business standards A new commodity exchange rule may be implemented on certification by the exchange the new or amended rule complies with the Commodity Exchange Act and Commission regulations. The CFTC may also direct a commodity exchange to change its rules or practices if violations are found. The National Futures Association performs similar functions for non-exchange member trading firms. The CFTC also regularly audits each exchange’s and the NFA’s compliance program.