![]()

- Predicting the future and futures price cycles based on coming events casting their shadows before the event takes place...

What has been will be again and what has been done will be done again; there is nothing new under the sun. ~eccl 1:9

After long years of practical experience, I have discovered Geometrical Angles measure accurately Space, Time, Volume and Price. Mathematics is the only real and exact science, as I have said before. Every nation on the face of the earth agrees 2 and 2 makes 4, no matter what language it speaks. Yet all other sciences are not in accord as mathematical science. We find different men in different professions along scientific lines disagreeing on problems, but there can be no disagreement in mathematical calculation. There are 360 degrees in a circle, no matter how large or how small the circle may be. Certain numbers of these 360 degrees and geometric angles are of vast importance and indicate when important tops and bottoms occur on stocks (and commodities), as well and denote important resistance levels. When you have thoroughly mastered Geometrical Angles, you will be able to solve any problem and determine the trend of any stock. ~W.D. Gann

Every movement in the market is the result of a natural law and from a Cause which existed long before the Effect takes place, which can be determined years in advance. The future is simply a repetition of the past, as the Bible plainly states; Every Top or Bottom in Wheat (or any other Commodity market) comes out in accordance with an exact mathematical proportion to some other previous high or low level, top or bottom. ~W.D. Gann

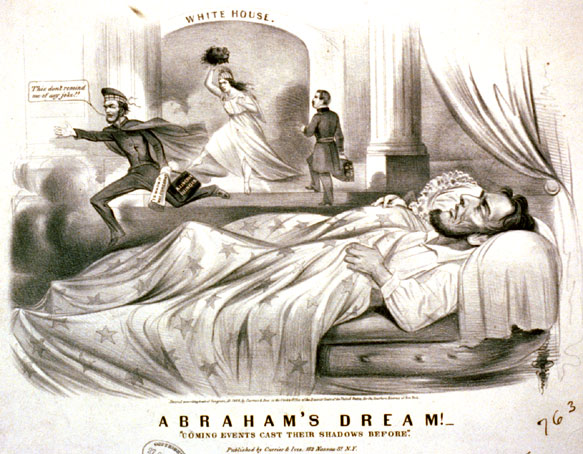

Future events involving commodity futures prices cast their shadows before the fundamental news breaks...

![]()

Reprinted Courtesy of "The Ticker and Investment Digest"

(which later became known as the Wall Street Journal)

December of 1909

William D. Gann

An Operator Whose Science and Ability Place

Him in the Front Rank

His Remarkable Predictions and Trading Records

Sometime ago the attention of this magazine was attracted by certain long pull Stock Market predictions which were being made by William D. Gann. In a large number of cases Mr. Gann gave us, in advance, the exact points at which certain stocks and commodities would sell, together with prices close to the then prevailing figures which would not be touched.

Go-here to Read More About Gann

For instance, when the New York Central was 131 he predicted that it would sell at 145 before 129. So repeatedly did his figures prove to be accurate, and so different did his work appear from that of any expert whose methods we had examined, that we set about to investigate Mr. Gann and his way of figuring out these predictions, as well as the particular use which he was making of them in the market.

The results of this investigation are remarkable in many ways.

It appears to be a fact Mr. Gann has developed an entirely new idea as to principles governing stock market movements. He bases his operations upon certain natural laws which, though existing since the world began, have only in recent years been subjected to the will of man and added to the list of so-called modern discoveries. We have asked Mr. Gann for an outline of his work, and have secured some remarkable evidence as to the results obtained therefrom.

We submit this in full recognition of the fact that in Wall Street a man with a new idea, an idea which violates the traditions and encourages a scientific view of the Proposition, is not usually welcomed by the majority, for the reason that he stimulates thought and research. These activities the said majority abhors.

W. D. Gann's description of his experience and methods is given herewith. It should be read with recognition of the established fact that Mr. Gann's predictions have proved correct in a large majority of instances.

"For the past ten years I have devoted my entire time and attention to the speculative markets. Like many others, I lost thousands of dollars and experienced the usual ups and downs incidental to the novice who enters the market without preparatory knowledge of the subject."

"I soon began to realize that all successful men, whether Lawyers, Doctors or Scientists, devoted years of time to the study and investigation of their particular pursuit or profession before attempting to make any money out of it."

"Being in the Brokerage business myself and handling large accounts, I had opportunities seldom afforded the ordinary man for studying the cause of success and failure in the speculations of others. I found that over ninety percent of the traders who go into the market without knowledge or study usually lose in the end."

"I soon began to note the periodical recurrence of the rise and fall in stocks and commodities. This led me to conclude natural law was the basis of market movements. I then decided to devote 10-years of my life to the study of natural law as applicable to the speculative markets and to devote my best energies toward making speculation a profitable profession. After exhaustive researches and investigations of the known sciences, I discovered that the law of vibration enabled me to accurately determine the exact points at which stocks or commodities should rise and fall within a given time."

The working out of this law determines the cause and predicts the effect long before the street is aware of either. Most speculators can testify to the fact that it is looking at the effect and ignoring the cause that has produced their losses.

"It is impossible here to give an adequate idea of the law of vibrations as I apply it to the markets. However, the layman may be able to grasp some of the principles when I state that the law of vibration is the fundamental law upon which wireless telegraphy, wireless telephone and phonographs are based. Without the existence of this law the above inventions would have been impossible."

"In order to test the efficiency of my idea I have not only put in years of labour in the regular way, but I spent nine months working night and day in the Astor Library in New York and in the British Museum of London, going over the records of stock transactions as far back as 1820. I have incidentally examined the manipulations of Jay Gould, Daniel Drew, Commodore Vanderbilt & all other important manipulators from that time to the present day. I have examined every quotation of Union Pacific prior to & from the time of E. H. Harriman, Mr. Harriman's was the most masterly. The figures show that, whether unconsciously or not, Mr. Harriman worked strictly in accordance with natural law."

"In going over the history of markets and the great mass of related statistics, it soon becomes apparent that certain laws govern the changes and variations in the value of stocks, and that there exists a periodic or cyclic law which is at the back of all these movements. Observation has shown that there are regular periods of intense activity on the Exchange followed by periods of inactivity."

Mr. Henry Hall in his recent book devoted much space to "Cycles of Prosperity and Depression," which he found recurring at regular intervals of time. The law which I have applied will not only give these long cycles or swings, but the daily and even hourly movements of stocks. By knowing the exact vibration of each individual stock I am able to determine at what point each will receive support and at what point the greatest resistance is to be met.

"Those in close touch with the market have noticed the phenomena of ebb and flow, or rise and fall, in the value of stocks. At certain times a stock will become intensely active, large transactions being made in it; at other times this same stock will become practically stationary or inactive with a very small volume of sales. I have found that the law of vibration governs and controls these conditions. I have also found that certain phases of this law govern the rise in a stock and an entirely different rule operates on the decline."

"While Union Pacific and other railroad stocks which made their high prices in August were declining, United States Steel Common was steadily advancing. The law of vibration was at work, sending a particular stock on the upward trend whilst others were trending downward."

"I have found that in the stock itself exists its harmonic or inharmonious relationship to the driving power or force behind it. The secret of all its activity is therefore apparent. By my method I can determine the vibration of each stock and also, by taking certain time values into consideration, I can, in the majority of cases, tell exactly what the stock will do under given conditions."

"The power to determine the trend of the market is due to my knowledge of the characteristics of each individual stock and a certain grouping of different stocks under their proper rates of vibration. Stocks are like electrons, atoms and molecules, which hold persistently to their own individuality in response to the fundamental law of vibration. Science teaches that 'an original impulse of any kind finally resolves itself into a periodic or rhythmical motion; also, just as the pendulum returns again in its swing, just as the moon returns in its orbit, just as the advancing year over brings the rose of spring, so do the properties of the elements periodically recur as the weight of the atoms rises."

"From my extensive investigations, studies and applied tests, I find that not only do the various stocks vibrate, but that the driving forces controlling the stocks are also in a state of vibration. These vibratory forces can only be known by the movements they generate on the stocks and their values in the market. Since all great swings or movements of the market are cyclic, they act in accordance with periodic law."

"Science has laid down the principle that the properties of an element are a periodic function of its atomic weight. A famous scientist has stated that 'we are brought to the conviction that diversity in phenomenal nature in its different kingdoms is most intimately associated with numerical relationship. The numbers are not intermixed accidentally but are subject to regular periodicity. The changes and developments are seen to be in many cases as somewhat odd."

Thus, I affirm every class of phenomena, whether in nature or on the stock market, must be subject to the universal law of causation and harmony. Every effect must have an adequate cause.

"If we wish to avert failure in speculation we must deal with causes. Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things. Faraday said, "There is nothing in the universe but mathematical points of force."

"Vibration is fundamental: nothing is exempt from this law. It is universal, therefore applicable to every class of phenomena on the globe."

Here are some (but not all) subjects covered in our highly recommended Gann Trading Course: Did W D Gann use Astrology in his Trading? (the answer may surprise you), Square Chart Definition and Usage; Squaring Price and Time; Geometric Angles; Angle Concepts; Gaps on Charts; What Causes Chart Gaps; The Gann Square of Nine and other powerful Gann trading methodologies, plus more about How To Square Price and Time.

This potentially highly profitable low-cost Gann techniques trading course offers every Gann trader the information needed to blend this powerful trading info into important commodities, forex futures & stock market trading and trade decisions.

Via the law of vibration every stock in the market moves in its own distinctive sphere of activities, as to intensity, volume and direction; all the essential qualities of its evolution are characterized in its own rate of vibration. Stocks, like atoms, are really centres of energy; therefore, they are controlled mathematically. Stocks create their own field of action and power: power to attract and repel, which principle explains why certain stocks at times lead the market and 'turn dead' at other times. Thus, to speculate scientifically it is absolutely necessary to follow natural law.

"After years of patient study I have proven to my entire satisfaction, as well as demonstrated to others, that vibration explains every possible phase and condition of the market."

ORDER BOTH COURSES - W. D. Gann's Commodities Trading Course - for a limited-time only $297.00 (regular price $495) - Plus the Gann Techniques Trading Course - $97 (includes FREE Magic Word) -- Both Courses for Only $347

Order W. D. Gann Commodities Trading Courses - FREE S&H USA only