International Commodities Trading Information Source

NICC Organization Traders New International Commodities Club

NICC is a Traders Guide to Making Money Trading US-Based or International Commodities Markets

Traders Article of the Month from New International Commodities Club...

I can say as of today's date it's been my experience there is a common perception among traders there exists a linear progression among the 3 requirements to be successful in trading:

1. psychology

2. money management

3. sound trading plan

However, my own experience as a trader suggests the progression thru these areas are not linear but instead a circular spiral.

For traders who actively trade (or desire to trade actively and learn how to trade) the financial and futures markets, there are a lot of other things outside the markets you should be following. But, I guess my bigger message is for those of you that aren’t in the futures markets, whether you trade them or not, the futures markets have a significant impact on what happens in the other financial markets, including forex, currencies, options and stocks. That’s why you should soak up every piece of good trading knowledge like a sponge in a quest to clearly see the bigger picture.

Our trading careers will be circular, because we will continuously move around the circle seeking to improve these three elements, incorporating new ideas and improving with the experience only 'hands on' commodity trading can bring. In the words of T. S. Elliott, "We shall not cease from our exploration and the end of all our exploring will be to arrive at where we started and know the place for the first time."

As novice traders, we need to begin by formulating a trading plan. Once a commodity trading plan has been developed to the best of our ability, then we move on to money management and lastly to the psychology of trading ... will come back to money-management and psychology, but meanwhile let's look more closely at the trading plan.

The role of the commodity trading plan is to provide a structure to work within an environment perceived as unstructured. This perception can give rise to the "fear of the unknown." The trading plan allows us to deal with this unknown. Also, once we have begun trading our plan, we need to have continued confidence in our ability to deal with the commodity market. Here we are dealing with the efficacy of the plan to produce profits and our state of mind as the plan interacts with the market.

Our commodity futures trading plan will need to have an edge. In my (trading) experience, the commodity plans that deliver an edge have the following common elements:

1. Trend Identification of moves of similar magnitudes. This includes tools to identify probable changes in trend. Once the trend is identified, we can determine the appropriate trading strategy (U.S. or international markets).

2. Low risk entry. This includes: identifying appropriate support and resistance areas; setups or warnings that alert the trader to a low risk opportunity; entry and initial stop placement techniques.

3. Trade Management. Once in the trade, we need to be able to manage the trade. Trade management includes trailing stop-loss orders and where to take profits.

4. Finally, the trading plan needs some tool to tell us when not to trade. For example, when there is an increase in volatility to the point that the our previous experience is of no assistance.

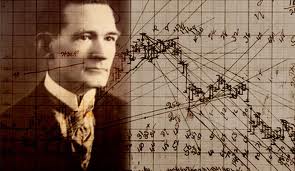

We can teach you how to trade the markets using Gann's best trading methods, including the powerful Geometric Angles Mr. Gann used so extensively, squaring of price & time, using valid gann style "square charts" and gann charting methods, support & resistance numbers and levels, "Gann numbers" and numerology. Our W. D. Gann Trading Course can teach you Gann's amazing methods for successful trading of commodity futures and stocks.

If you closely read and study our unique Gann Course it's quite likely you will learn how to use and implement important Gann trading methods in your trading within 72-hours. This Gann traders course was written by Dave of Webtrading who has studied and used Gann's methods for the past 30-plus years, including studying squaring-price-and-time. He is considered an expert on Gann and Gann's methodology.

Trading the financial markets using Gann methodology can work well when trading forex and other futures markets, including the stock market. W D Gann was much more involved in inter-day (position trading) vs intra-day (day trading) and mostly used daily bar-charts. With that said, Mr. Gann's trading techniques can be effectively used to day-trade too with the methods also being applicable to intra-day charts such as hourly charts. Daytrading was not as popular during Gann's time like it is now.

Here are some (but not all) of the key subjects covered in our highly recommended Gann Techniques Trading Course, which can effectively be used to trade stocks or futures markets using our course based on Gann's unique trading methods.

Our Gann trading course contains much of Gann's secrets and techniques to potential successful trading of main-stream commodities, forex currencies and stocks and the stock market, using "hands-on plan English" learning skills. Includes many lessons, charts, plus annotated copies of Mr. Gann's old charts done in his own hand-writing. Our Gann Trading Course also includes a unique custom-made acrylic custom Gann angles tool, with instructions for drawing Gann angles on Gann methodology square price charts.

In this Gann Course we address issues such as: Did W. D. Gann use Astrology in his Trading (the answer may surprise you); Square Chart Definition and Usage; Squaring Price and Time; Geometric Angles; Which Gann Angle is most important (answer about why it's so powerful is easy to comprehend); Angle Concepts; Gaps on Charts; What Causes Chart Gaps; The Gann Square of Nine and other powerful Gann methods, plus more about Squaring of Price and Time.

Why spend $1,000 or more elsewhere to learn Gann's trading techniques when you can learn W. D. Gann Techniques in this course at very low-cost; teaching William D. Gann's unique methodology, for a fraction of the price? The cost is only $97 with free shipping. This potentially highly profitable Gann Secrets (explained) trading course offers all Gann traders (both new and experienced) the secrets and knowledge needed to blend these powerful Gann trading techniques into commodities, futures & stock market trading decisions, which can bring you profits. Order by Clicking-on Buy Now...

The next point in the circle is the development of a set of sound money management rules. I believe money management comes after the trading plan, because the money management rules will depend to a large degree upon the real-time trading results of the trading system. Also, you will not truly appreciate the importance of money management until you have experienced for ourselves the erratic or disappointing results that come from applying a promising trading plan without a set of money management rules.

The questions trade money management rules need to address are:

1. How much trading capital is needed to finance one contract in a particular market? For example, a trader may decide he needs $40,000 (margin) to trade one Treasury Bond contract and $30,000 to trade one Japanese Yen contract (or international commodity markets).

2. What percentage of capital is risked on each trade? i.e. 2% or 5%, etc?

3. Are opportunities across competing instruments treated as equal?

4. Are trading opportunities within the some instrument treated as equal?

5. Are successive opportunities in the same instrument treated as equal?

Once a commodity trading plan and a set of good money management rules have been developed, we need to take the plan into the commodity market. It is at this point that we will not only discover more about our plan, but more importantly we will discover more about our own psychology. For instance, we may discover we are unable to execute the plan in the market, or we are unable to execute it flawlessly.

Before we can progress, we must remedy any problems which have arisen so far. To overcome these problems, we may need to adjust our trading plan and/or look closely at our own psychological makeup. For instance, the commodity trading plan may need to be made simpler or more robust so that we find it easier to execute the trade. Another trading situation could be finding our psychology is such that we are more suited to one type of commodity trading other than the commodity trading style of our trading plan, for example long-term commodity trading vs day trading.

Once we are able to execute the trading plan without error, then we can go to the next step - that is, are we ready to accept the rewards from the perfect execution of our plan? We may suddenly find ourselves unable to accept a steady stream of money from the market. This problem normally manifests itself with having a series of wins only to give back profits in one or two unplanned trades finishing from where we started. Again, we will have to go back and look at our own psychology and try to remove any blocks that are stopping us from reaping the rewards of our efforts.

At the completion of this task, we will be back at the beginning of the loop - the trading plan. After completing the loop traders will not only have new ideas to test and incorporate, but also be able to adjust the plan to better suit our psychological development as a commodities futures trader.

Once again quoting T. S. Elliot, "through the unknown, remembered gate when the last of earth left to discover is that which is the beginning."