Cattle Trading System

Welcome to Cattle Trading System

![]()

You may want to later try a different grains trading system simply login to your club membership area, enter your unique club membership number and one more Cattle trading system will be sent to you. There is no limit to how many times you can do this (beyond the number of trading-systems we have available at any given time). As you wait for the CattleTradingSystem system development to complete, you can visit commodity trading traders site. In addition, you can also learn about free futures trading seminars. We will soon be offering new memberships to our new cattle trading system club so please visit again.

Trading the CME Live Cattle Futures Market can be Profitable

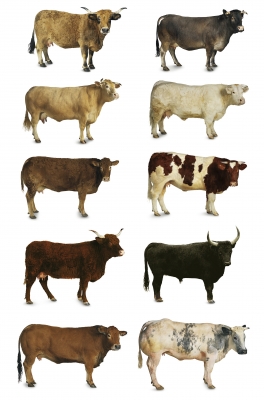

Live cattle means the cattle which is fat and ready for the slaughter house and is different with the feeder cattle, which are younger ones. The live cattle futures are actively traded at the Chicago Mercantile Exchange (CME). The market ticker and data symbol is LC with the LC contract futures trading in cents per pound. Whenever the trading is done through electronic sessions, it is known as LE. Live cattle delivery and commodity trading is done in the months of February, April, June, August, October and December.

The live cattle futures market is connected to the supply and demand of feeder cattle, the cost of other meats, the prices of feed grains especially corn supplies, and the future outlook of meat supplies and consumer behavior. It is a non-storable apparatus but has a role to play for both the producers and packers of the commodity. The cattle futures market depends mainly on the production of the meat, the meat-eating desires and demand of the consumers, which makes it a good futures trading opportunity.

The investment in the cattle futures market needs complete information on the part of the investor. The market is engaged usually in beef production and consumption by the consumers all over the world and depends on the price variations. The cattle futures market is mainly the beef market which is based on the sophisticated technology in its various stages. Hence it requires a good amount of knowledge to gather information about the trading of the cattle futures market for an investor to know the right time of investment to make profits. In this context, the live cattle futures market has to depend on the delivery of cattle on premiums or discounts and the workings involved in the physical delivery of the commodity.

Live cattle futures are actively traded at the CME exchange in Chicago. The normal unit of trading of live cattle stands at 40,000 pounds of a specific quality of cattle, which are made suitable for delivery to another point in U.S. Both types of cattle the live cattle and feeder cattle are taken for trading at CME. The live cattle are the slaughtered meat which is around 1,250 pounds and the dressed meat should be around 750 pounds. These are the fundamentals of live cattle futures market. There are large cattle producing states in the USA, which include Arizona, California, Colorado, Illinois, Iowa, Kansas, Nebraska, Texas and the Dairy State of Wisconsin.

The live-cattle futures market and trading is susceptible to unusual incidents like what happened with the mad cow disease or the e-coli salmonella threats recently. These incidents can reflect on the demand of live cattle and accordingly prices are affected. The recovery from the panic-stricken stage takes some time to get back to normal. The effects are not long-term due to food consumption habits unless consumers decide to change drastically their food habits as it happened in some parts of Japan and South Korea. The use of beef is mostly domestic and the consumer demand takes up the prices to its original place within a very short time and trading in the live cattle futures become profit earning activity. This lucrative trading of live cattle futures market is solely reliant on the demand and supply of the commodity and prices fluctuate accordingly.

Chicago Mercantile Exchange – Dairy, beef, and hog futures and options. Cheese is traded at the CME on a cash basis.  Lumber, stock indexes, foreign exchange rates and other products are also traded at the CME.

Lumber, stock indexes, foreign exchange rates and other products are also traded at the CME.

Cattle – Futures and Options are available on live cattle and feeder cattle. Trading is open from 9:05 am to 1:00 pm Monday thru Friday. The contract size for live cattle is 40,000 pounds with 55% choice and 45% select. The contract size for feeder cattle is 50,000 pounds of medium and large frame steers weighing 700-849 pounds. Prices move in $.025/cwt increments.

The daily price limit is $1.50/cwt above or below the previous day’s settlement but can be increased under certain conditions. The contract months for live cattle rotate every 2-years but are typically offered every other month. Contract months for feeder cattle are January, March, April, May, August, September, October, and November. The last trading day for live cattle is the last business day of the contract month. The final trading day for feeder cattle is the last Thursday of the contract month except November, when it is the Thursday before Thanksgiving Day.