A 17th-Century mania in Holland is the most dramatic and amazing of all commodity price increases and subsequent collapse of historical magnitude

How to Successfully Trade Futures Markets. Tip: Make profits with contrary trading by going opposite direction vs maddening crowd

A good date to start studying commodity prices, Kondratieff Wave cycles and evaluating the madness of crowds is today if you want to make profits in trading and go the opposite of the mad crowd . . . Forex futures or foreign exchange futures are also known as currency futures, or FX markets. It's a futures contract used in exchanging one currency for another currency at a fixed priced on the purchase date and at a specific future delivery date. The dollar is the typical currency used in the forex futures markets. It is also the underlying commodity in the same fx markets. Currency futures do not have any difference from all other commodities in the market. A good currencies trading system is basically traded the same way as other commodities futures markets.

Futures prices are based on the cash currency markets, although there are some differences. For instance, currency futures are traded via established commodity exchanges such as the Chicago commodity exchange and the Oil exchange for example. However, forex futures are traded via electronically traded currency markets.

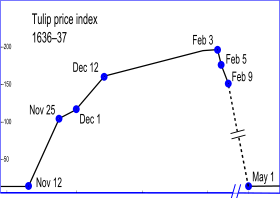

Tulip bulb market mania was long ago in Europe in the 1600s. The crowd mania was a time period when tulip-bulbs reached amazing price but suddenly collapsed. At its peak tulip mania (caused by extraordinary popular delusions and the madness of crowds) in 1637, futures contracts sold for incredible money, greater than 10-times 17th century annual income of Dutch skilled workers (modern-day Netherlands) when futures on a single tulip-bulb sold for a truly astonishing 5,400 Guilders on the Dutch Futures market at its top, which was more than cost of buying a nice Amsterdam house! Amazing but true!

Currencies are not heavily government controlled like futures markets are and because of this, some day-traders prefer the currency futures better. Moreover, currency futures do not suffer the problems currency markets are experiencing such as non-centralized prices, and trading of currency brokers against their clients.

Forex futures currencies are usually based on the exchange rates of two currencies; the U.S. Dollar and the Euro. These currencies are settled in cash, in the principal currency. For instance the Euro futures market is based upon the exchange rate of Euro to US Dollar. Once a Euro futures contract expires, there is a cash worth in Euros received by the holder. However, this only happens when the expiration of the contract is reached. In addition, day traders do not normally hold futures contracts until it reaches expiration. They should not also involve in any settlement as well as received deliveries of the principal currency.

Apart from Euro and US dollar, other popular currency futures in the market include British Pound, Swiss Franc, Australian Dollar, and Canadian Dollar. These currencies are offered by the Chicago Mercantile Exchange or the CME. The currency markets have the most popular trading markets as well as the most volume number of contracts and liquidity. Because of this, the markets become attractive to all types of entities and traders including governments, big banks, non-financial companies, financial companies, trading companies, individual small traders and day traders.

The two basic trading strategies that use forex derivatives are speculating and hedging. Speculating usually incur risks in order to make profits while hedging uses forex futures to eliminate or reduce risks by protecting itself from any future price movements.

The main purpose of using commodities hedging strategies in Forex futures market is to balance the fluctuation effects of currencies based on sales revenue. In this strategy, traders often choose between a derivative known as the forward and the futures. Meanwhile, the speculating strategy is profit-driven by nature. Its advantages include lower spreads, lower per-transaction costs, and more leverage.

On the other hand, its disadvantages include requirement of a higher amount of capital, limited session trading times compared to much longer currency trading hours, and extra fees from the The National Futures Association (NFA). The trading techniques used in commodity futures speculating trade strategies are basically the same methods used in the forex spot market, also known as the spot forex markets.

We will be offering a currency trading system soon. However, in the meantime the absolute best trading advise we can give you is always use a stop-loss order to protect you from losing too much money on trades where you have a wrong position. Get out with a small loss so you can continue trading without wiping out your account equity and that way you have the opportunity to recover from your losing trade and become profitable overall.

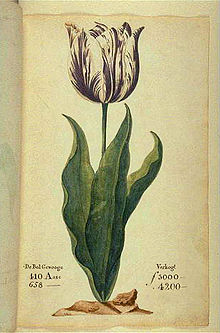

The 1637 Dutch Catalog 'Viceroy' tulip bulb cost was listed at an incredible 3,000 Dutch Guilders (later selling for 5,400 Guilders), which was 10 to 18 times the yearly salary of a skilled Dutch craftsman!

The 1637 Dutch Catalog 'Viceroy' tulip bulb cost was listed at an incredible 3,000 Dutch Guilders (later selling for 5,400 Guilders), which was 10 to 18 times the yearly salary of a skilled Dutch craftsman!

The Foundation engaged in cycles research about all kinds of time/price cycles for potential high-reward futures trading.

![]()

We are On a Mission Providing Information

to Achieve Success in Commodities Trading

Keep in mind, the prices of commodities such as gold, diamonds,

copper, silver, platinum, crude oil, wheat, corn and other commodity futures markets can literally collapse at any time (with little if any warning or widely known cause) possibly even overnight, which can greatly impact commodity futures traders carrying overnight trade positions) when trading at very high price levels (compared to historical prices). After a major or wild bull market (like the famous 17th Century Madness of Crowds Tulip Bulb Mania) the collapse could happen suddenly and dramatically, and frequently does.

copper, silver, platinum, crude oil, wheat, corn and other commodity futures markets can literally collapse at any time (with little if any warning or widely known cause) possibly even overnight, which can greatly impact commodity futures traders carrying overnight trade positions) when trading at very high price levels (compared to historical prices). After a major or wild bull market (like the famous 17th Century Madness of Crowds Tulip Bulb Mania) the collapse could happen suddenly and dramatically, and frequently does.

The commodities mania which started in Holland in the 1600s is the most dramatic and amazing of all commodity price increases and subsequent collapse,

and was a mania of historical proportions and significance, which was the tulip bulb market long ago in Europe (modern-day Netherlands) in the 17th century. Tulip mania aka tulip bulb mania; was a time period in the Dutch Golden Age when futures trading contract prices for tulip bulbs of the recently introduced tulip reached incredibly high price levels, but then abruptly and without warning collapsed.

and was a mania of historical proportions and significance, which was the tulip bulb market long ago in Europe (modern-day Netherlands) in the 17th century. Tulip mania aka tulip bulb mania; was a time period in the Dutch Golden Age when futures trading contract prices for tulip bulbs of the recently introduced tulip reached incredibly high price levels, but then abruptly and without warning collapsed.

At the peak of the commodity futures price mania (caused by popular delusions and madness of crowds) in February of the year 1637, commodities futures contracts sold for an incredible amount of money, greater than 10-times the annual income of a Dutch skilled craftsmen at that time!

A single tulip-bulb sold for 5,400 guilders on the Dutch commodity futures market at the market peak, which stunning price was more than the cost of buying an Amsterdam house! Amazing but true.

The amazing bull market mania followed by a devastating bear market collapse was the first recorded speculative economic bubble bursting, and took place on what is believed to be the world's first organized commodity futures exchange. Today's term 'tulip mania' is now used as an analogy to refer to any large financial market bubble which has already burst, or obviously will soon burst.

More recent modern day manias include the great bull markets in real estate (already collapsed vs its highs of 2005-2006), and recent major bull markets in specific stocks and the stock market in general, wheat, crude oil, silver, copper, and today's extremely elevated gold price. If commodity markets like those have not already collapsed you can certainly expect that to happen soon but probably no where near the amazing magnitude (both up and down) of he insane commodities trading mania of four centuries ago!

This is why you must always watch for a change in trend, and always place an active stop-loss order to avoid large losses. Be willing to take a small loss if the trade and trend turns against your position. That way you have some funds left to recover and make winning trades again. Refer to the amazing tulip price chart and keep in mind the price of the modern day gold market (or any other commodity) could also burst one day. In fact, you can basically count on the commodity prices collapsing sooner or later, usually sooner!

Go to CTCN for more trading information about price cycles and commodity trading mania's, delusions and the madness of crowds which happened in Europe starting in the year 1636-1637...

Recommended Trader Resources

![]() Price Cycles organization traders website

Price Cycles organization traders website